Exploring the realm of global health insurance for digital nomads, this introduction sets the stage for a comprehensive discussion that delves into the intricacies of securing health coverage while embracing a nomadic lifestyle.

Detailing the significance of prioritizing health insurance and the peace of mind it brings, the subsequent paragraphs offer a glimpse into the world of digital nomads and their unique insurance needs.

Overview of Global Health Insurance for Digital Nomads

Global health insurance for digital nomads refers to insurance plans specifically designed to provide coverage for individuals who live a location-independent lifestyle and travel frequently. These insurance plans offer a range of benefits such as medical emergencies, routine healthcare, hospitalization, and more, regardless of the country the digital nomad is in.Having health insurance while living a nomadic lifestyle is crucial for digital nomads as it ensures access to quality healthcare services without the financial burden of high medical costs.

In case of unexpected illnesses or accidents, having health insurance provides peace of mind and allows digital nomads to focus on their work and travels without worrying about healthcare expenses.

Popular Global Health Insurance Providers for Digital Nomads

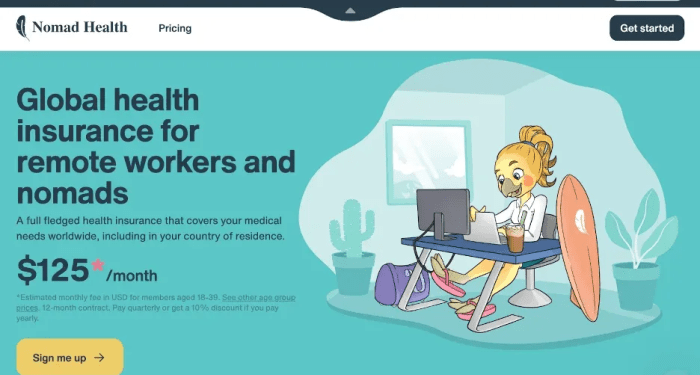

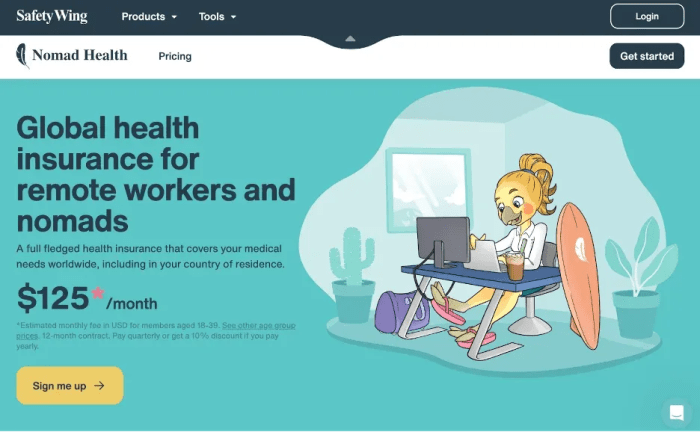

- 1. SafetyWing: SafetyWing offers a comprehensive global health insurance plan specifically designed for digital nomads and remote workers. Their plans cover medical expenses, hospitalization, emergency evacuation, and more in various countries around the world.

- 2. Cigna Global: Cigna Global provides international health insurance plans that are suitable for digital nomads who travel frequently. Their plans offer comprehensive coverage for medical emergencies, routine healthcare, mental health services, and more.

- 3. Allianz Care: Allianz Care offers flexible health insurance plans for expats, digital nomads, and global citizens. Their plans provide coverage for medical treatment, hospitalization, outpatient services, and emergency evacuation in different countries.

Coverage and Benefits

![6x Best Digital Nomad Health Insurance [2025 Review] 6x Best Digital Nomad Health Insurance [2025 Review]](https://ca.zonajakarta.com/wp-content/uploads/2025/10/insured-nomads-global-health-insurance-1024x571-1.png)

Global health insurance plans for digital nomads typically offer comprehensive coverage designed to meet the unique needs of individuals who travel and work remotely. These plans often include benefits such as emergency medical evacuation, telemedicine services, and coverage for preventive care.

Emergency Medical Evacuation

Emergency medical evacuation coverage is essential for digital nomads who may find themselves in remote locations where medical facilities are limited. This benefit ensures that in the event of a medical emergency, the policyholder can be transported to the nearest appropriate medical facility for treatment.

Telemedicine Services

Telemedicine services allow digital nomads to consult with healthcare providers remotely, eliminating the need for in-person visits for minor health concerns. This benefit is particularly valuable for individuals who may not have easy access to healthcare services while traveling.

Preventive Care Coverage

Global health insurance plans often include coverage for preventive care services such as vaccinations, screenings, and wellness exams. This helps digital nomads stay healthy while on the move and ensures that they can access essential preventive healthcare services regardless of their location.

Specific Coverage Options

Some specific coverage options that are essential for digital nomads include coverage for pre-existing conditions, medical expenses related to adventure sports or activities, and mental health services. These additional coverage options ensure that digital nomads have the support they need to stay healthy and safe while pursuing their nomadic lifestyle.

Cost and Affordability

Global health insurance for digital nomads can vary significantly in cost depending on various factors. The price of these insurance plans can be influenced by several elements, including the coverage offered, the individual's age, the destination countries covered, and any additional benefits included in the plan

Digital nomads must carefully consider these factors when selecting a health insurance plan to ensure they are adequately covered while also staying within their budget.

Factors Affecting Cost

- The extent of coverage provided: Plans offering more comprehensive coverage, including medical emergencies, routine check-ups, and dental care, will typically come at a higher cost.

- Age of the individual: Younger digital nomads may be able to secure more affordable premiums compared to older individuals due to the lower risk of health issues.

- Destination countries covered: Some insurance plans may exclude coverage in certain countries or charge higher premiums for regions with higher healthcare costs.

- Additional benefits: Extras such as coverage for adventure sports, mental health services, or maternity care can increase the overall cost of the insurance plan.

Tips for Finding Affordable Insurance

- Compare multiple plans: Digital nomads should research and compare different insurance providers to find a plan that offers the best value for their needs and budget.

- Consider higher deductibles: Opting for a plan with a higher deductible can lower monthly premiums, making the insurance more affordable in the long run.

- Look for group plans: Some organizations or platforms offer group health insurance plans for digital nomads, which can be more cost-effective than individual policies.

- Explore regional options: Depending on the nomad's travel destinations, they may find more affordable insurance plans tailored to specific regions or countries.

Considerations for Digital Nomads

When it comes to choosing a global health insurance plan as a digital nomad, there are several important considerations to keep in mind. Given the unique lifestyle of constantly changing locations and flexible work schedules, digital nomads require a health insurance plan that can adapt to their needs wherever they may be in the world.

Flexibility in Coverage

One of the key considerations for digital nomads is the flexibility in coverage that a health insurance plan offers. Since digital nomads frequently change locations and may travel to different countries, it is essential to have a plan that provides coverage worldwide.

This means ensuring that the plan includes international coverage and access to a network of healthcare providers in various countries.

Additional Features and Services

Apart from basic medical coverage, digital nomads may benefit from additional features and services that cater to their unique lifestyle. Some insurance plans offer telemedicine services, which allow digital nomads to consult with healthcare providers remotely, regardless of their location.

Other beneficial features may include coverage for emergency medical evacuation, access to multilingual customer support, and easy online claims processing.

Conclusive Thoughts

Concluding the discourse on global health insurance for digital nomads, this final section encapsulates the key points discussed, leaving readers with a profound understanding of the topic and its implications.

FAQ Compilation

What is the coverage provided by global health insurance for digital nomads?

Global health insurance typically includes coverage for medical emergencies, doctor visits, prescription medications, and sometimes dental and vision care.

How can digital nomads find affordable health insurance?

Digital nomads can explore group insurance plans, consider higher deductibles for lower premiums, or opt for insurance providers specializing in coverage for nomadic lifestyles.

Why is flexibility in coverage important for digital nomads?

Flexibility allows digital nomads to access healthcare services in different countries without limitations, accommodating their ever-changing locations and needs.

What are some additional services beneficial for digital nomads in health insurance plans?

Additional services like telemedicine, emergency medical evacuation, and coverage for adventurous activities can be particularly useful for digital nomads.