Exploring the benefits of bundling car and house insurance can lead to significant cost savings and simplified insurance management for policyholders. Dive into the world of combined policies with this comprehensive guide.

Importance of Combining Car and House Insurance

Combining car and house insurance policies can offer a range of benefits to policyholders, including cost savings and simplified insurance management.

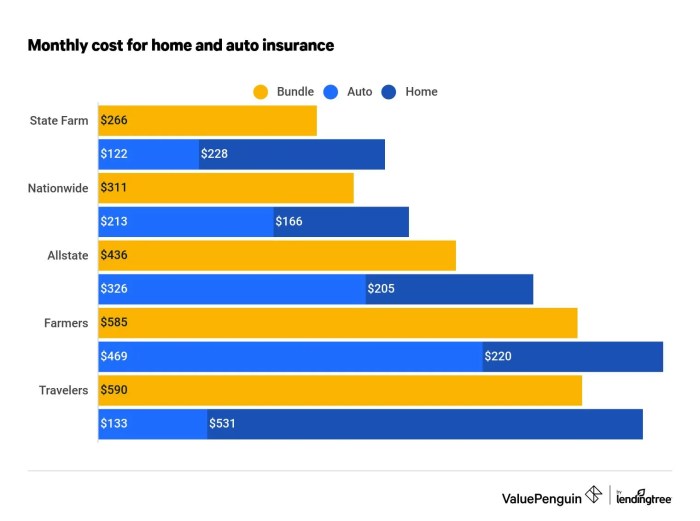

Cost Savings

When you bundle your car and house insurance policies with the same provider, you can often receive a discount on your premiums. Insurance companies offer these discounts as an incentive to encourage customers to consolidate their policies. By taking advantage of these savings, you can reduce your overall insurance costs.

Simplified Insurance Management

Managing multiple insurance policies from different providers can be complex and time-consuming. By combining your car and house insurance with one company, you streamline the process by dealing with a single insurer for both policies. This can make it easier to keep track of your coverage, premiums, and policy details, ultimately simplifying your insurance management.

Factors to Consider Before Combining Quotes

When looking to combine car and house insurance quotes for maximum value, there are several key factors to consider. Understanding your coverage needs for both types of insurance, how bundling affects premiums and deductibles, and how to evaluate insurance providers for bundled policies can help you make an informed decision.

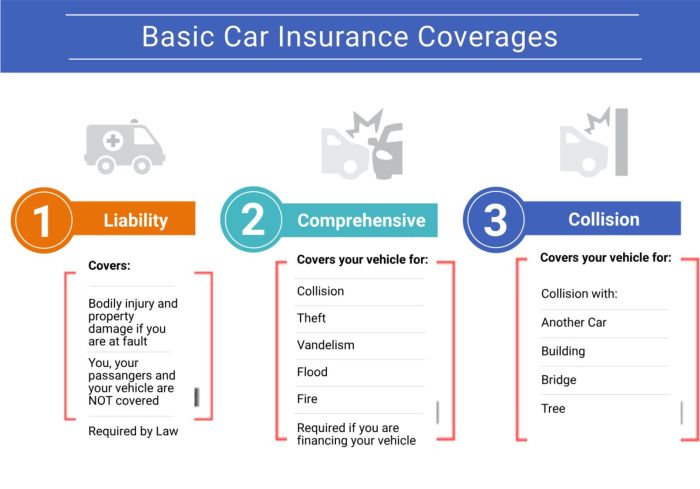

Identify the coverage needs for both car and house insurance

Before combining quotes, it's important to assess your coverage needs for both car and house insurance. Consider factors such as the value of your assets, your driving habits, the location of your home, and any specific risks you may face.

By understanding what coverage is essential for both policies, you can ensure that you are adequately protected.

Discuss how bundling affects premiums and deductibles

Bundling car and house insurance policies with the same provider can often lead to discounts on premiums. Insurance companies may offer reduced rates for customers who purchase multiple policies from them. Additionally, bundling can result in lower deductibles, making it more affordable to file a claim in the event of an accident or damage to your property.

It's important to compare the cost savings of bundling versus purchasing separate policies to determine the most cost-effective option.

Share tips on evaluating insurance providers for bundled policies

When evaluating insurance providers for bundled policies, consider factors such as the reputation of the company, customer service reviews, financial stability, and the range of coverage options available. Look for providers that offer competitive rates for bundled policies and have a history of providing excellent customer support.

It's also important to review the terms and conditions of the policies to ensure that they meet your specific needs and requirements.

Obtaining and Comparing Insurance Quotes

When it comes to combining car and house insurance for maximum value, obtaining and comparing insurance quotes is a crucial step in the process. It allows you to see what different providers offer and helps you make an informed decision based on your needs and budget.

Obtaining Car and House Insurance Quotes Separately

When obtaining car and house insurance quotes separately, you can reach out to insurance companies directly, either online or over the phone. Provide them with all the necessary information about your vehicles and property, as well as your personal details, to get accurate quotes.

You can also use online comparison tools to get quotes from multiple providers at once, making the process more convenient.

Comparing Quotes from Different Providers Effectively

Once you have gathered quotes from different providers, it's essential to compare them effectively. Look beyond the premium costs and consider the coverage limits, deductibles, and any additional benefits or discounts offered. Pay attention to the details of each quote to ensure you are getting the best value for your money.

Reviewing Coverage Limits and Exclusions in Quotes

Reviewing coverage limits and exclusions in insurance quotes is crucial to understanding what is included and what is not. Make sure you are comfortable with the coverage amounts for both your car and house insurance policies

Maximizing Value in Combined Insurance Policies

When combining car and house insurance, it's essential to customize your coverage to suit your individual needs. Tailoring your policy ensures that you are adequately protected while avoiding unnecessary costs for coverage you don't need.

Tips for Customizing Coverage:

- Assess your specific needs for both car and house insurance to determine the level of coverage required.

- Consider factors such as the value of your assets, driving habits, and property risks to adjust coverage limits accordingly.

- Explore additional coverage options, such as umbrella policies or riders, to enhance protection for valuable assets or unique risks.

Potential Discounts Available:

- Insurance providers often offer discounts for bundling multiple policies, such as car and house insurance, under one account.

- Additional discounts may be available for factors like security systems in your home, safe driving records, or loyalty to the insurance company.

- Ask your insurance provider about available discounts and ensure that you are maximizing your savings by combining policies.

Negotiating for Better Rates:

- Research competitive rates from different insurance providers to leverage in negotiations with your current insurer.

- Highlight your loyalty as a policyholder and inquire about loyalty discounts or incentives for combining car and house insurance.

- Be prepared to negotiate the terms of your policy, including deductibles, coverage limits, and premium rates, to achieve the best value for your combined insurance.

Epilogue

As we conclude this discussion on combining car and house insurance quotes for maximum value, remember to customize your coverage, seek potential discounts, and negotiate for better rates to make the most out of your insurance policies.

FAQ Overview

What are the benefits of bundling car and house insurance?

Bundling can lead to cost savings, simplified management, and potential discounts.

How does bundling affect premiums and deductibles?

Bundling can often result in lower premiums and deductibles compared to separate policies.

What should I consider when evaluating insurance providers for bundled policies?

Look at coverage needs, compare quotes effectively, and review coverage limits and exclusions.

How can I customize coverage to suit my individual needs?

You can tailor coverage options based on your specific requirements and preferences.

Are there discounts available when combining car and house insurance?

Yes, insurance providers often offer discounts for bundled policies.