Commercial Auto Policy vs Personal Auto Insurance Explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

When comparing commercial auto policies to personal auto insurance, a world of distinctions emerges that can impact coverage, costs, and overall protection. Let's delve into the nuances of these two insurance types to uncover the essential disparities that every vehicle owner should be aware of.

Commercial Auto Policy vs Personal Auto Insurance Overview

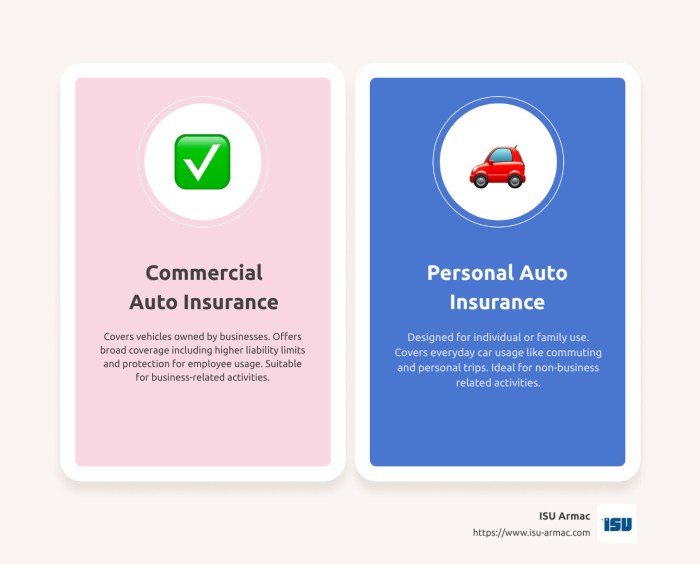

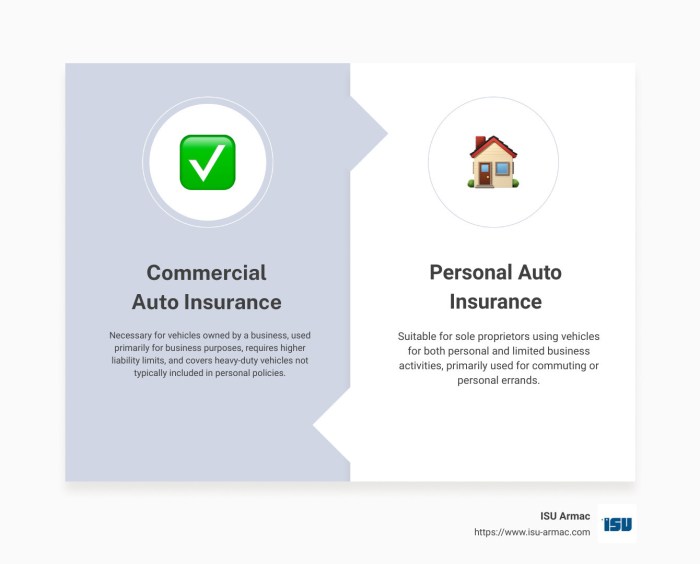

When it comes to auto insurance, there are significant differences between commercial auto policies and personal auto insurance. Commercial auto insurance is designed to cover vehicles used for business purposes, while personal auto insurance is meant for vehicles used for personal reasons.

Examples of Situations

- Commercial Auto Insurance: A company that uses vehicles to transport goods or provide services such as a delivery service, taxi service, or construction company would require commercial auto insurance to protect their vehicles and employees.

- Personal Auto Insurance: An individual who uses their vehicle for commuting to work, running errands, or personal travel would typically have personal auto insurance to cover their vehicle in case of accidents or damages.

Coverage Limits and Premiums

Commercial auto insurance usually has higher coverage limits than personal auto insurance due to the increased risk associated with business use. Premiums for commercial auto insurance are also typically higher than those for personal auto insurance due to the higher liability and coverage amounts needed to protect a business.

Coverage Differences

When comparing commercial auto policies to personal auto insurance, there are some key differences in the coverage options offered.

Liability Coverage

Liability coverage is a fundamental component of both commercial and personal auto insurance policies, but the limits and requirements may vary significantly between the two. In commercial auto policies, liability coverage tends to be higher due to the increased risks associated with business-related driving activities.

Additionally, commercial auto policies may offer coverage for non-owned vehicles used for business purposes, which is typically not included in personal auto insurance.

Additional Coverages

- Commercial auto policies often include coverage for hired and non-owned vehicles, which provides protection when employees use their personal vehicles for business purposes.

- Business interruption coverage is another common inclusion in commercial auto policies, helping cover lost income if your business operations are disrupted due to a covered auto accident.

- Cargo insurance is typically available as an add-on to commercial auto policies, offering protection for goods being transported in your commercial vehicles.

- Employer's non-ownership liability is a crucial coverage for businesses that rent or hire vehicles for their employees to use. This coverage protects the business in case an employee gets into an accident while driving a rented or hired vehicle for work purposes.

Considerations for Business Use

When it comes to insurance coverage for vehicles used for business purposes, it is essential to understand the differences between personal auto insurance and commercial auto policies. In some cases, a personal auto insurance policy may not provide adequate coverage for vehicles used for business activities.

Scenarios Requiring Commercial Auto Policy

- Delivery Services: If a vehicle is regularly used for delivering goods or services as part of a business, a commercial auto policy is necessary to ensure coverage for potential accidents or damages during these deliveries.

- Transporting Goods: Vehicles used to transport goods for commercial purposes, such as a truck delivering inventory to a retail store, would require a commercial auto policy to cover any incidents that may occur during transportation.

- Ridesharing: For vehicles used for ridesharing services like Uber or Lyft, a commercial auto policy is typically needed to ensure coverage while carrying passengers for hire.

Insurance Companies' Determination

Insurance companies typically determine the need for a commercial auto policy based on the primary use of the vehicle. If the vehicle is primarily used for business activities, such as transporting goods, carrying passengers for hire, or making deliveries, then a commercial auto policy would be required to adequately cover the associated risks.

Insurance providers may also consider the frequency and nature of business use when assessing the need for a commercial policy.

Premium Determinants and Costs

When it comes to commercial auto policies versus personal auto insurance, the way premiums are calculated can vary significantly. Understanding the factors that influence premium costs for both types of insurance is crucial for businesses to make informed decisions on which type of insurance is more cost-effective for their needs.

Premium Calculation for Commercial Auto Policies

Premiums for commercial auto policies are typically calculated based on a variety of factors, including:

- The type of business and industry the vehicle is used in

- The driving records of employees who will be operating the vehicles

- The number of vehicles insured under the policy

- The purpose of the vehicle use (e.g., deliveries, transportation of goods)

- The radius of operation for the vehicles

Commercial auto insurance premiums are usually higher than personal auto insurance premiums due to the increased risks associated with business vehicle use.

Premium Calculation for Personal Auto Insurance

On the other hand, personal auto insurance premiums are determined by factors such as:

- The driver's age, gender, and driving record

- The type of vehicle insured

- The driver's location and mileage driven

- The coverage limits and deductibles chosen

- The driver's credit score in some cases

Personal auto insurance premiums are generally lower than commercial auto insurance premiums since personal vehicles are typically used for non-business purposes.

Cost-Effectiveness of Commercial Auto Insurance for Businesses

When comparing the cost-effectiveness of commercial auto insurance versus personal auto insurance for businesses, it is essential to consider the specific needs and risks associated with the business operations. While commercial auto insurance may have higher premiums, it provides more comprehensive coverage tailored to business use, including liability protection for employees and goods in transit.

Businesses that rely on vehicles for daily operations and have multiple drivers may find that the benefits of commercial auto insurance outweigh the higher costs in terms of coverage and protection.

Closure

As we conclude this exploration of Commercial Auto Policy vs Personal Auto Insurance, it becomes evident that choosing the right type of insurance is crucial for safeguarding your assets and business interests. By understanding the key differences and considerations between these two insurance options, individuals and business owners can make informed decisions that align with their unique needs and circumstances.

Questions and Answers

When should I consider a commercial auto policy over personal auto insurance?

You should opt for a commercial auto policy when using your vehicle for business purposes, transporting goods, or carrying passengers for hire.

What additional coverages are typically included in commercial auto policies but not in personal auto insurance?

Commercial auto policies often include coverages such as hired auto liability, non-owned vehicle coverage, and loading/unloading liability, which are not commonly found in personal auto insurance.

How do insurance companies determine if a vehicle requires a commercial policy based on its usage?

Insurance companies typically assess the vehicle's primary use, frequency of business-related trips, type of cargo transported, and whether the vehicle is used for delivery or commercial service to determine if a commercial auto policy is necessary.